March 21, 2022

By Marites Dañguilan Vitug

25 years of failed collection

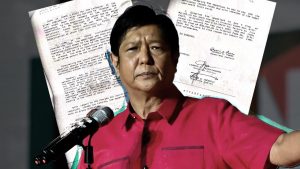

This is a seismic disregard for the rule of law. Ferdinand “Bongbong” Marcos Jr., as a co- executor of his late father’s estate, refuses to pay billions in taxes and lies about it. There’s no other way to put it politely.

Fact #1: In 1997, the Supreme Court ruled that the estate tax assessments of Ferdinand Marcos were “final, executory and enforceable.” At the time, the Bureau of Internal Revenue’s (BIR) computation was at P23.3 billion. This has since ballooned to P200 billion because of penalties and interest charges.

What did Marcos Jr., the frontrunner presidential candidate, have to say about this? “In my case, whatever the court orders me to do, I will do,” he declared in a forum last week. But why is the BIR still running after him and his mother, Imelda, both executors of the estate?

Fact #2: In December last year, the BIR sent the Marcos heirs a demand letter, flagging them on their tax liabilities, according to Caesar Dulay, BIR commissioner. Thus far, through five administrations, the Marcoses have ignored notices of their unpaid taxes.

Let’s go to the background of the case to understand its twists and turns. These are based on the 1997 Supreme Court decision’s narration of facts.

Fact #3: After the dictator’s death in 1989, the BIR formed a special audit team to investigate his tax liabilities and found that the Marcos heirs failed to file the estate tax – in violation of the National Internal Revenue Code. In 1991, the BIR commissioner filed a tax return for the estate of the late president. The amount? P23.3 billion. Copies of the estate tax assessments were served at the San Juan address of the Marcos heirs.

Fact #4: In 1992, the BIR served formal assessment notices for Imelda in the office of Marcos Jr. at the House of Representatives. Imelda and the other heirs did not protest the deficiency tax assessments within 30 days from when the notices were served.

Fact #5: In February and May 1993, the BIR commissioner issued notices of levy on parcels of land owned by the Marcoses to partly pay for the estate tax.

Fact #6: In June 1993, Marcos Jr. questioned the BIR’s estate tax assessments in the Court of Appeals, seeking a temporary restraining order against the levy.

Fact #7: In July 1993, a public auction for the sale of 11 parcels of land took place. There was no bidder thus the lots were declared forfeited in favor of the government.

Fact #8: In 1994, the Court of Appeals ruled that deficiency assessments for the estate tax have become “final and unappealable.” Marcos Jr. elevated the case to the Supreme Court.

Like octopus

Twenty five years after the Supreme Court ruled with finality, the ghost of the billions in tax debt haunts Marcos Jr.

To deflect blame for this huge debt to the government, the camp of Marcos Jr., like an octopus, is squirting ink at the issue, obscuring the public’s view.

Victor Rodriguez, spokesperson of Marcos Jr., said in a statement that the properties upon which the estate tax case was computed are “still under litigation.” Moreover, he pointed out that the BIR and the Presidential Commission on Good Government (PCGG) had agreed that the “BIR should wait for the decision…to determine with accuracy the fair and just tax base to be used in computing estate taxes.”

Two red flags here. First, how can the properties be under litigation when the Supreme Court had already settled the matter?

Second, why would two government agencies enter into an agreement to wait for the computation of the estate tax when both were aware of the Supreme Court ruling?

We have an answer from the PCGG.

Fact #9: In 2003, the PCGG and the BIR agreed that the latter collect the estate tax due on all Marcos assets “except…those that are sequestered or subject of a recovery case by the PCGG…”

The agreement had nothing to do with Rodriguez’s claim that both agencies had yet to determine the computation of the estate tax—another lie from the Marcos camp.

As Antonio Carpio, former Supreme Court justice, said in a statement:

The verbal agreement is only between two government agencies –the BIR and PCGG. The Marcoses are not parties to the verbal agreement – therefore they are not bound by the agreement and they cannot invoke the agreement in their favor.

Besides, the reason for the agreement is to collect the estate tax from Marcos assets that are not yet in the custody of the court so as to maximize the collection of the government.

Moreover, the BIR and PCGG are not questioning the basis for the computation of the estate tax and its total amount which they expressly acknowledge is already final, executory and unappealable.

Moreno’s promise

Thanks to the camp of presidential candidate Isko Moreno for getting to the bottom of the issue. It was Ernest Ramel, chairman of Aksyon Demokratiko, who wrote the PCGG to find out what had really happened and the BIR to check if it wrote the Marcoses to demand payment of their tax liabilities.

Earlier, Moreno made a campaign promise to collect the estate tax of a “family,” without mentioning the Marcoses. “I will make sure I will implement the decision of the Supreme Court, G.R. 120880, June of 1997 na may isang pamilya na pinagbabayad ng estate tax (where one family was made to pay estate tax). As we speak, it’s about P200 billion already,” Moreno said in February.

The existential question that makes me shudder is: What if Marcos Jr. wins?

Rappler.com

—————————–

Marites Dañguilan Vitug

@maritesdvitug

Marites is one of the Philippines’ most accomplished journalists and authors. For close to a decade, Vitug – a Nieman fellow – edited ‘Newsbreak’ magazine, a trailblazer in Philippine investigative journalism. Her recent book, ‘Rock Solid: How the Philippines Won Its Maritime Case Against China,’ has become a bestseller.