The rich and other higher income groups will have larger take home pay than previously estimated under the new tax law, while the poor will still bear the brunt of paying higher taxes. The highest earning 40% or about 9.1 million households will have even more money in their pockets under the recently passed Tax Reform For Acceleration and Inclusion (TRAIN) Law compared to the original DOF proposal.

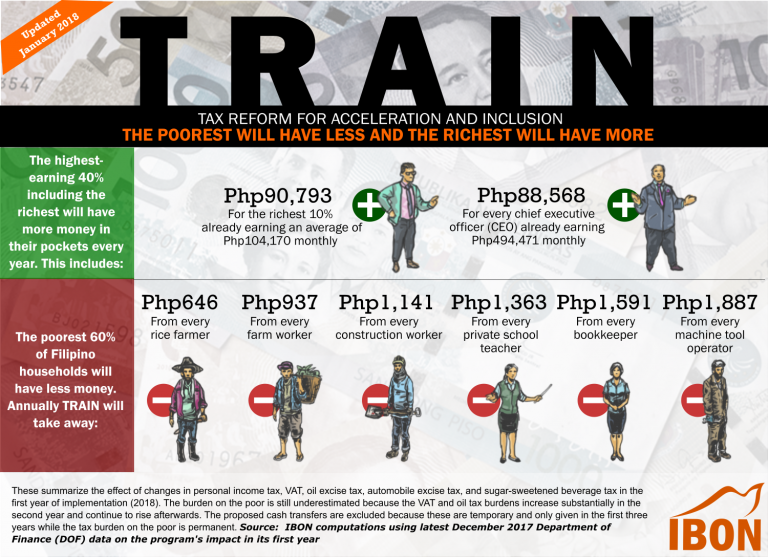

Using July 2017 data from the Department of Finance (DOF) on the first year impact of TRAIN, IBON previously estimated that the richest 10% earning an average of Php115,428 monthly will have an additional Php33,795 annually. But IBON’s computations based on the latest December 2017 DOF data shows that the richest 10%, now estimated by the DOF to be earning an average of Php104,170 monthly, will have an additional Php90,793 annually.

This includes how a chief executive officer (CEO) among the top 0.1% of families already earning Php494,471 monthly will take home an extra Php88,568 annually. This is a reversal of the previous estimate that a CEO among the top 0.1% earning Php706,017 would lose Php20,694, said the group. Middle income and lower-middle families meanwhile take home an additional Php7,880 to Php24,343 under TRAIN.

Meanwhile, the poorest 60% of Filipino households or 13.7 million households will continue to have less money under the new tax law, though figures based on the more recent data are slightly lower than previously estimated. Under TRAIN in 2018, every rice farmer (first and lowest income decile) will lose Php646 annually; every farm worker (second income decile) will lose Php937; every construction worker (third income decile) will lose Php1,141; every private school teacher (fourth income decile) will lose Php1,363; every bookkeeper (fifth income decile) will lose Php1,591; and Php1,887 will be taken from every machine tool operator (sixth income decile).

Contrary to government claims, majority of Filipinos will not benefit from income tax exemptions from TRAIN. About 15.2 million families who already do not pay income tax because they are minimum wage earners or informal sector workers with erratic incomes will not have any income tax gains. Yet while not getting increased take home pay, they will have to endure price hikes as a direct or indirect effect of higher consumption taxes. (From “Even more money for the rich under TRAIN law–IBON”, 12 January 2018 IBON Media Release)