These reiterations are in reaction to the article “Assessing TRAIN” by Mr. Filomeno Sta. Ana of the Action for Economic Reforms (AER), which appeared on the January 8, 2018 issue of Business World.

IBON has repeatedly presented its evidence-based analysis of the TRAIN (basing on the Department of Finance data no less) and consistently deepened our explanations to the public. Our 40 years of institutionalisation has equipped us with analysis sets to provide a popular understanding of socio-economic issues.

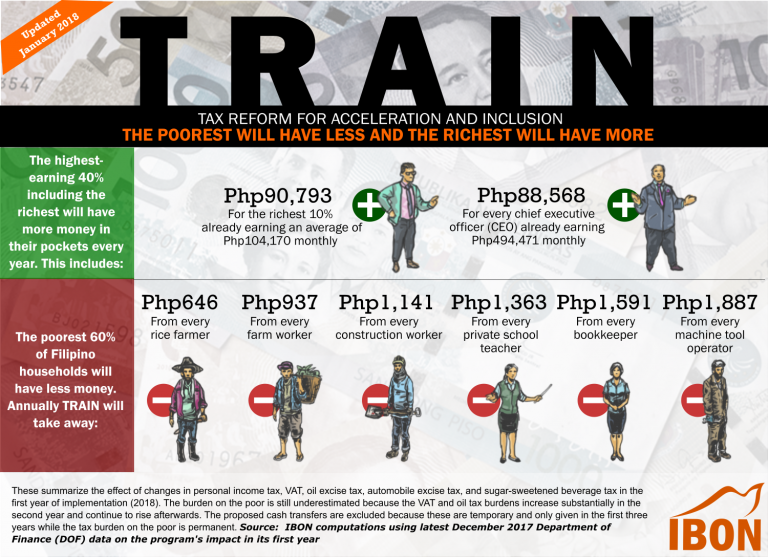

The Duterte administration claims that the Tax Reform for Acceleration and Inclusion (TRAIN) Law will benefit the poor in terms of lower personal income tax, unconditional cash transfers, and new infrastructure. It also describes the new tax law to be inclusive and even progressive. IBON belies these false claims. Under TRAIN, the poor stand to lose while the rich will gain.

- TRAIN will not benefit the poor majority of Filipinos with lower personal income tax. According to the government, 6.8 million low- and middle-income families will be completely exempted because they are earning less than the Php250,000 personal income tax threshold. But this figure includes millions of minimum wage earners or otherwise those in informal work with low and erratic incomes already exempted by law. The 6.8 million families certainly deserve income tax cuts to cope with rising costs of living. But of the country’s total 22.7 million families, the personal income tax cuts for most of the reported 7.5 million personal income tax payers still leaves as much as 15.2 million families without any income tax gains from this measure. Yet, at the very start of 2018, these families have already had to deal with more expensive goods, such as food and drinks, and cooking expenses. Jeepney and bus fares, electricity and other utility fees are bound to increase due to new taxes on oil products including liquid petroleum gas (LPG), kerosene, diesel, and gasoline. Other price hikes abound when the imposition of value-added tax (VAT) on previously exempted services and goods takes effect. Note that the value-added tax slapped on petroleum products per Republic Act 9337 of 2005 drove up inflation from 6.0% in 2004 to 7.6% in 2005.

- TRAIN is pro-rich. Government slams TRAIN critics who say that the tax program is anti-poor. Yet it is the country’s richest who are among the biggest gainers from TRAIN’s income tax reforms. The richest 1% of families with incomes of over Php1.5 million or more a year will have an average of Php100,000 to over Php300,000 additional take-home pay annually especially when income taxes are lowered further in 2023. This is on top of how the rich will pay billions of pesos less in estate and donor taxes. Also, the richest 10% already earning an average of Php104,170 monthly according to Department of Finance data, will have Php90,793 more every year. Meanwhile, every chief executive officer (CEO) already earning Php494,471 monthly will have Php88,568 more in their pockets every year.

- TRAIN-provided cash transfers are temporary. That TRAIN will provide P200 per month in unconditional cash transfers to the poorest 10 million Filipino households from 2018 to 2020 is an indirect admission by government that the TRAIN’s taxes do put an additional burden on the poor. The relief ends after the third year while the greater TRAIN tax burdens are permanent.

- Infrastructure spending is biased away from poor regions, and biased away from the kind of infrastructure projects that the poor directly need or will directly use. There is a general trend of higher infrastructure spending in regions of low poverty incidence, and low infrastructure spending in regions of high poverty incidence. This is observed when comparing the value and regional distribution of the government’s flagship infrastucture projects and poverty incidence by region. For instance, the NCR has the lowest official poverty incidence of 3.9% but takes up the largest chunk of flagship projects at Php343 billion, while the Autonomous Region of Muslim Mindanao (ARMM) with the highest official poverty incidence of 53.7% accounts for among the least flagship projects at just Php5.4 billion. Also, instead of irrigation, milling factories, and post-harvest facilities; public schools; public hospitals; and mass housing, which millions of poor Filipinos need for their livelihoods and welfare, the Duterte administration’s flagship projects are mostly big-ticket transportation infrastructure eyed by oligarchs and their foreign counterparts for business, such as roads, bridges, fly-overs, railways, seaports, and airports.

- TRAIN remains regressive. The Duterte administration claims that TRAIN is progressive, but this should mean that the people are taxed according to their capacity to pay. On the contrary, the poor stand to bear the greater burden under TRAIN. According to official data, only the richest 20% Filipinos earn the family living wage (FLW or the amount needed by a family of 5 to live decently ) or more (Php30,000 per month on the average for 5 persons). Meanwhile, the poorest 80% earn way below the family living wage, but they are being made to pay the same additional taxes as the richest, while the latter will even be relieved of certain tax obligations. While the middle class deserve lower personal income taxes, it is unjust that those earning millions monthly should be taxed less.

Government can undertake concrete measures towards genuinely progressive taxation by raising direct taxes on the richest such as personal income tax and corporate income tax, while reducing indirect taxes such as VAT and other taxes on consumer products. IBON also proposes steps, which, while temporary, may ease the burden on the poorest: (1) Maintain exemptions on products where the poorest are directly affected; (2) Tax the rich more, specifically, raise taxes on those belonging to the highest income bracket; and (3) Allocate specific budget items for essential social services.

(sgd)

Sonny Africa

IBON Executive Director